Does Tax Preparation Stress You Out?

I finished my taxes about a week ago. Medical circumstances caused us to leave them until the last minute. Getting the data together was stressful. Even last year, when someone else prepared our taxes, we had to find and list all the data on the accountant's form.

|

| Image Courtesy of Pixabay, Text Added on FotoJet.com |

It's not hard for me to enter data into tax software. I stress out when I don't have the data handy to enter. My husband manages our rental business and keeps the records in a black book. He files receipts -- all receipts and documents -- in an accordion file I find it hard to look through. Some tax information is in check registers and credit card statements. I keep my business records in a desk organizer designed for taxes.

This year at tax time everything came to a head. I had trouble finding the documents I needed in his file. He couldn't find property tax records and I had to chase them online. I had to organize all the credit card statements for several different cards. Year-end statements from banks and insurance had not been filed anywhere and we had a treasure hunt. Part of the problem is that most mail still goes to our other house where he does his work. He gets behind in filing and things get lost.

By the time we finished our taxes this year, I decided our system must change. We have got to start this year's tax preparation now -- not after the first of next year. This year is already one-third gone as I write this. The day after I finished the tax preparation and we mailed the taxes, I started sorting this year's receipts. Here are three things I'm doing now to make tax time easier and less stressful next year. You may want to do them, too.

1. Have the Proper Organizers on Hand

I use two desk organizers. One is for paying bills so I don't get behind. The other is for organizing receipts and other documents in tax categories. When the mail comes in, I pull any bills or important tax documents immediately. Bills go into my bill organizer by month. I usually put the date due on the envelope and put them in the pocket in order of when bills are due with the first to be paid on top. Documents go immediately into the tax organizer.

After the bills are paid, they are marked with the date paid and method by which they were paid. If I pay online by electronic transfer, I write the confirmation number in the check register and also on the bill itself. Then I file the paid bills where they belong. Credit card statements are filed by issuing bank in separate folders. It's too bulky to put them in the tax organizer book pockets. Statements from the medical insurance companies also go in the file cabinet, as do utility bills and other bills that come every month and may not be tax deductible.

Medical receipts for out-of-pocket payments to medical professionals go into the proper pocket in the tax organizer. So do year-end interest and income statements, 1099 forms, and business expense receipts. Here are some very good organizers.

I personally use the Adams Tax Preparation Organizer pictured above. It has pockets to hold receipts for each tax category. Above the pockets are lines for listing the records contained with their dollar amounts. The inside front cover explains what belongs in each pocket.

The All-in-One Income Tax Organizer pictured would be a good substitute for the larger more complex accordion file my husband uses. The Budget Book pictured would make it easier to keep track of personal finances than the organizer I use now. It has more budgeting features for keeping track of anticipated expenses and income. The Tax Minimiser is designed especially for small business owners.

2. Set Aside a Time Every Week to Organize Receipts

Early Preparation Prevents Last Minute Stress

This year's mad dash to find the receipts and documents we needed to prepare our taxes was stressful enough to send Hubby to the ER. I'm determined to avoid that last-minute stress next year. We started so late this year that we had missed our accountant's deadline to get data to him. We would have had to file an extension. But one needs to have a good idea of how much one will owe before filing that extension. We really had no idea.

That's why we decided to go back to doing the taxes ourselves using

TurboTax, my favorite tax software. I have used it for years, and I was pleasantly surprised to find it was even easier to use this year. Because I have two small businesses now and we both help with the rental business, we needed the Home and Business version of TurboTax. It has all the tax schedules we need.

By doing the taxes ourselves, we were able to prepare them at the last minute and know for sure how much we needed to pay. We also saved ourselves about $800. Waiting until the last minute created stress, though. I needed to finish the day before taxes were due because of a previously scheduled a doctor appointment on the day taxes were actually due. I didn't realize it was the day taxes were due when I made the appointment.

We bought the software on a Wednesday and then we tried to get the data together. I worked on my Schedule C forms and Personal Information while Hubby gathered the other data on the rentals for Schedule E.

We had to work almost nonstop during the day and evenings, but we did take a break for two hours on Friday night for dinner and TV. Then I went back to my computer and Hubby went back to his black book.

A few minutes later he developed some mild chest pain, so we were off to the Emergency Room. He does have heart problems, and it seemed wise to be safe rather than sorry. He was OK, but we didn't get home until early morning and we had to sleep late. Neither of us was at our best for the rest of the day, either, and we had to spend Easter Sunday working on taxes. We did finally finish by the deadline.

Weekly Organization During the Tax Year Could Have Prevented This Stress

As demonstrated above, we can't know ahead what the future holds. We cannot predict medical events that can occupy our time when we had intended to start our taxes. The solution? Start preparing your taxes for next year now by keeping receipts organized as you get them. At least once a week make sure you have receipts in the proper pocket of your organizer and that you have written the business purpose for each receipt.

As you pay your credit card bills each month, circle deductible expenses and make sure you have the register receipts that match them in your file. If you manage rental properties, make sure you write on each receipt which property it was for and the purpose of the purchase. Then you won't have to look at your Home Depot or Lowe's receipt the next year and try to figure it out. It's much easier to remember what you did during the week than what you did last year.

Keep all register receipts that have some sales tax on them -- especially if you don't pay a state income tax. As tax law stands now, you can deduct the amount of sales tax you paid or the amount you paid in state income tax (but not both) on your federal return. Keep receipts from stores and from online purchases. I have a file in my email program just for receipts from online orders. Taxes on just those purchases came to several hundred dollars last year.

I have already started preparing my taxes for this year using this kind of organization. I have instructed my husband to bring home all receipts and mail for me to go through so I can see that they are properly labeled and won't be hard to find next year at tax time. I still have the first four months of this year to catch up on, but I've been using my tax organizer since January. I always make sure I have the new one before the end of December each year so I don't have to wait to get documents and receipts where they belong.

If you don't have your tax organizer for this year yet, get it now. Pick up an extra for next year while you are at it. Also, make sure you

get a bill organizer or some financial software to make sure you always remember to pay your bills on time.

I prefer a desk bill organizer since I thought

Quicken was too complicated for my situation when I previously used it years ago. Even though it imports bank and other financial information automatically, it was not intuitive to use. I made mistakes because I didn't understand how to use it properly and those mistakes were impossible to undo. If you can use it properly, Quicken makes it easy to import your tax information directly to TurboTax.

3. Keep Track of Deductible Mileage

Whether you use your car as an employee of a company or for your own business, you may be able to deduct your mileage. To do that you have to keep track of your business miles driven.

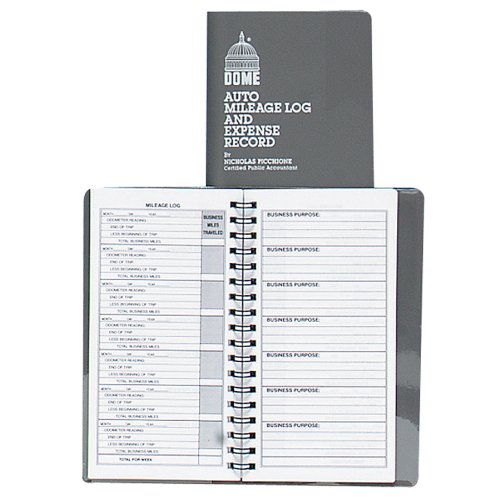

I cannot stress this enough. It's best if you keep a mileage log in your car. I have always found the Dome three-pack pictured below adequate for my needs. It's a great deal if you use more than one car at your house for business or other deductible trips. Besides space for logging mileage, there is space for recording car expenses and parking fees. You can deduct not only business mileage but also mileage for transportation to medical appointments and work you do for charity. Current tax laws may change, but it never hurts to keep track.

The one thing you must write down each year is your beginning and ending odometer reading. Without that, you will have a tough time deducting any of your mileage. We record it in the logbook and on our calendars on December 31 of the old year and January 1 of the new tax year. Make writing that starting mileage part of your New Year's celebration.

Believe me, you don't want to have to reconstruct the beginning and ending mileage from repair receipts or insurance mileage data a month or two from the beginning or end of the year.That means having to use your calendar and habits to reconstruct all the miles you drove for any reason between your receipt date and the beginning or end of the year, and your figure may not be 100% accurate.

Sometimes we can get impatient or find that it's hard to read the odometer and record mileage for every trip. We often make the same trips repeatedly for business, as when we visit a certain rental property, bank or the post office. You may only need to document the exact mileage for that place once, and then just record the date, place, and miles traveled the next time you go. Another great way to see how many miles it is to a destination is to use Google Earth. When you ask it for directions from one place to another, it will give you the total miles for the route you take.

Whatever System You Use, Start Now to Relieve Tax Preparation Stress Next Year

I prefer the organizers that sit on my desk to keep my finances and tax records in order. You may prefer software or some other system. What's important is to have some system that works for you and keep your records filed year round. Then when taxes are almost due you won't need to have a treasure hunt for missing receipts and documents. If there is a medical or some other emergency near the tax deadline, you will be much better prepared to face it if you aren't worried about getting your taxes done. You will already be organized and ready to plug the data into your forms or software.

Disclosure: This post is not intended to give legal tax advice. It is based on my own experience. To be sure you prepare your taxes to conform to the latest changes in the law, consult a tax professional and/or only use tax software with the latest updates.

Note: The author may receive a commission from purchases made using links found in this article. “As an Amazon Associate, Ebay (EPN), Esty (Awin), and/or Zazzle Affiliate, I (we) earn from qualifying purchases.”